Why

The Islamic financial sector represents a particular sector within the global financial industry. The total Islamic financial assets have a combined value of nearly $3.9 trillion. This sector is based on the basic principles of Islamic law, known as Shariah. Investing in the Islamic financial sector is considered a form of social and ethical responsibility, as it aims to avoid profit from riba, which most Islamic scholars interpret as interest, while some consider rather as usury. In addition, Islamic financial institutions avoid gharar, which is investing in high-risk or speculative ventures. Risk must be shared equally among all parties involved in a business venture. It is also forbidden to invest in sectors contrary to Islamic morality, such as businesses related to alcohol, gambling (such as casinos) or pork.

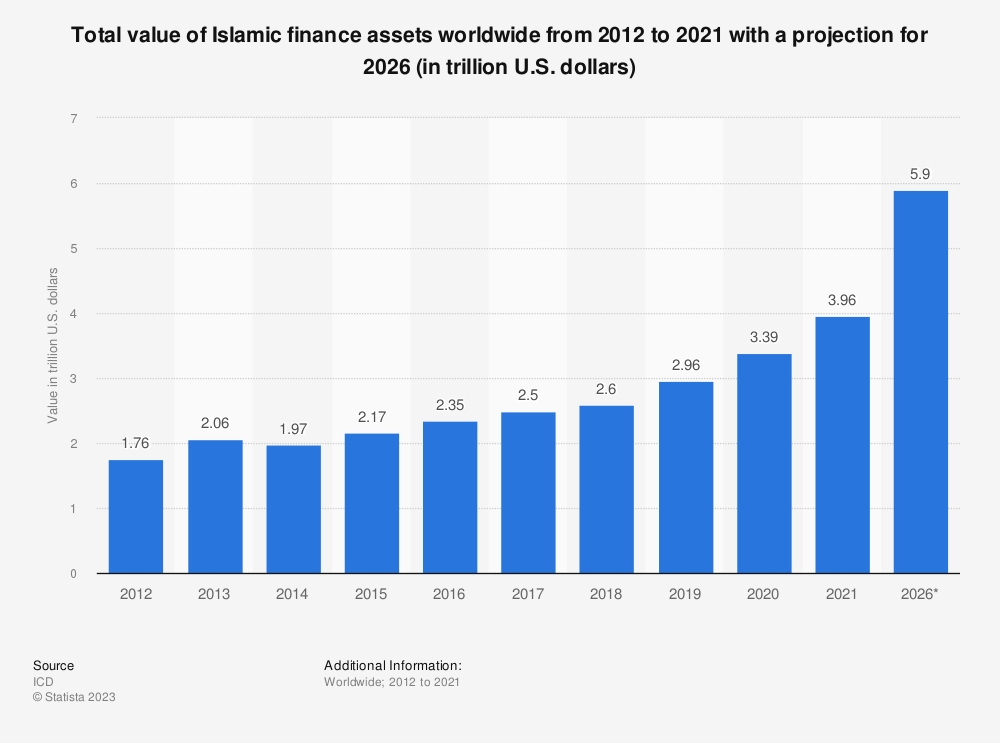

Both finance and the Islamic economy continue to experience robust growth, contributing significantly to global economic growth. According to authoritative sources such as Dinar Standard and Statista (July 2022), Islamic finance grew by 125 per cent between 2012 and 2021, far outpacing the growth of the traditional banking sector. The Muslim population, a large catchment area for the Islamic economy, is also growing steadily. In 2010, the number of Muslims globally reached 2.07 billion, accounting for about 25 per cent of the global population. This figure underscores the enormous growth potential and significant socio-economic impact that the Islamic economy can have internationally.

The growth of the Islamic economy and finance is a noteworthy phenomenon that increasingly influences the global economic landscape, creating new investment opportunities and promoting the development of financial products by the principles of Islam. This continued expansion offers exciting prospects for the world economy, placing the Islamic economy as an increasingly significant player in international financial markets.

The City of Turin believes that Islamic finance is a useful tool for bringing the Islamic community closer and contributing to its integration and that it can be a platform for attracting investment to the territory from those countries where Islamic finance plays a decisive role in economic and employment development.

Italy is the third-largest economy in the euro area and the ninth-largest globally, with a GDP of more than $2.108 trillion. Turin is one of Italy’s major industrial cities but also an important cultural centre of excellence that has been able to diversify its business sectors and, therefore, fully meet the needs of Islamic finance. Some of these areas will be discussed during the different editions of TIEF: the real estate, gastronomy, insurance, tourism, healthcare, biotechnology and infrastructure, finance, aerospace, sports, and automotive sectors.

TIEF is an excellent opportunity to meet with some of Italy’s leading corporate leaders, financial service providers, entrepreneurs, legislators, regulators, researchers, practitioners and academics.

All will be invited to engage with Islamic finance investors and key financial market players.

Islamic Finance

Islamic finance is the set of all those financial transactions that conform to the principles of Sharia (an Arabic term for the high road to salvation).

Islamic economics is based on the principle of wealth distribution to achieve justice, equality, fairness and economic balance within society.

The basic principles of Islamic finance include the prohibition of Riba (usury), the prohibition of Gharar (uncertainty/speculation), the prohibition of Maysir (gambling), and the prohibition of non-halal investments, i.e., the prohibition of Haram (unethical) activities, products, or services, such as alcohol, tobacco, pork, pornography, and weapons.

Islamic finance in numbers

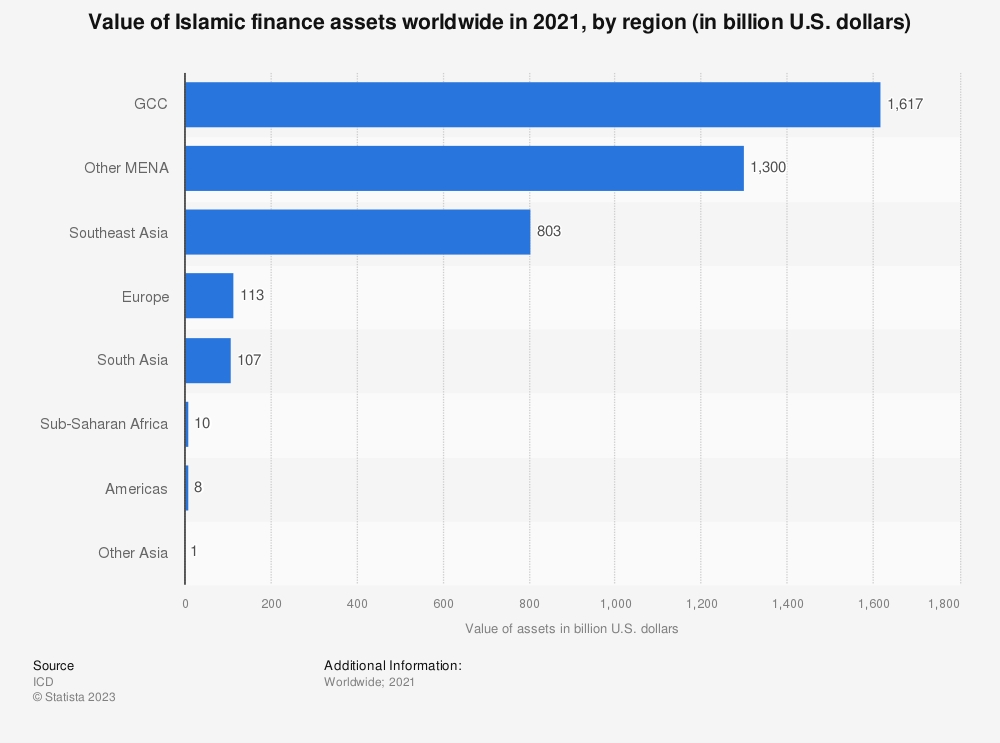

Islamic finance has a global presence in more than 75 countries. Financial assets are primarily located in Gulf countries ($1,617 billion), other countries in the Middle East and North Africa ($1,300 billion), Southeast Asia ($803 billion), Europe ($113 billion) and South Asia ($107 billion). These numbers also include Takaful and Sukuk.

The numbers of the halal market

Food and beverage

According to the State of the Global Economy Report (Dinar Standard, 2022), Muslim spending on food and beverages increased by 6.9 per cent in 2021, from $1.19 trillion to $1.27 trillion, and is expected to grow by 7.0 per cent in 2022 and reach $1.67 trillion in 2025, a 7.1 per cent growth rate per year. Increasingly, Muslim consumers who do not live in countries of origin are seeking halal foods. This increases the local market by pushing the value of food safety and new technologies that enable more effective traceability of products.

Fashion

Muslim spending on fashion increased by 5.7 per cent in 2021, from $279 billion to $295 billion, and is expected to grow by 6.0 per cent in 2022, reaching $313 billion and $375 billion in 2025, a four-year growth rate of 6.1 per cent. Challenges for Islamic fashion include e-commerce and omnichannel marketing that enable clothing export to all countries worldwide.

Medicines

Pharmaceutical spending by Muslims increased by 6.5 per cent in 2021, from $93.5 billion to $100 billion, and is expected to grow by an additional 6.7 per cent in 2022, reaching $106 billion and $129 billion in 2025, a 6.7 per cent year-on-year growth rate. The drug sector, as well as the food and beverage sector, is also experiencing growth due to exports and the role of technology in the processes of certifying production steps.

Cosmetics

Spending by Muslims on cosmetics increased by 6.8 per cent in 2021, from $65 billion to $70 billion, and is expected to grow by an additional 7.2 per cent in 2022, reaching $75 billion and $93 billion in 2025, a 7.4 per cent growth rate per year.

Riba

Riba, usury, is prohibited. Riba means unjustified gain, the enrichment produced by money. Instead, lending money for business purposes is allowed based on profit and loss sharing principles.

Gharar

Gharar, uncertainty, means excessive risk in Arabic. The terms and conditions of the risks and contract, such as between buyer and seller, must be fully understood and accepted by both parties involved in the financial transaction to ensure the full consent of all parties to the contract.

Maysir

Maysir in Arabic means gambling, such as the lottery, and is prohibited because of unwarranted gains and increased wealth due solely to luck, resulting in the passing of wealth from one person to another to the detriment of society.

Halal and Haram investments

The acquisition of property by Muslims must be through ethically permissible activities defined by the Arabic term Halal. These activities can be carried out through trade and partnership investments.

Muslims are prohibited from engaging in Haram, i.e., unethical activities. Unethical Haram activities are not only represented by the prohibitions of riba, gharar and maysir but also by all those specific activities and industries prohibited from an ethical and social point of view, such as investments in alcoholic beverages, pornography, weapons and pork products.

Sukuk

The term Sukuk in Arabic refers to certificates (Sukuk is the plural form of Sak), an alternative to traditional bonds. In common bonds, the borrower is obligated to repay the initial counter value plus the agreed interest rate, while Sukuk is structured so that earnings are linked to the underlying asset, and lenders boast a certificate of ownership over it.

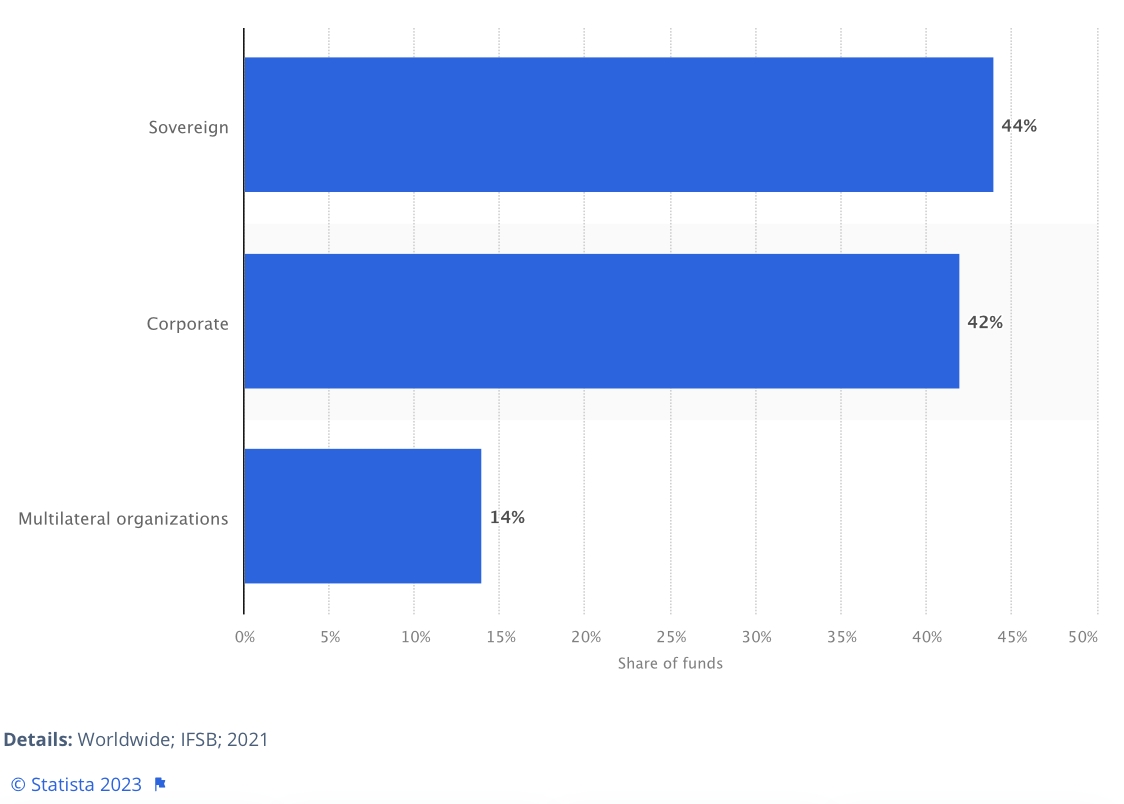

The Sukuk market offers many opportunities, particularly in infrastructure development. In 2014, the United Kingdom was the first Western government to issue an Islamic bond finding a significant level of interest and attracting orders from global investors of £2 billion ($2.85 billion), followed in the same year by Luxembourg with a €200 million ($254 million) 5-year Islamic bond. The latest data from the Islamic Financial Services Industry Stability Report 2022 show that 44 per cent of Sukuk are issued by sovereign states, 42 per cent by corporations, and 14 per cent by multilateral organisations.

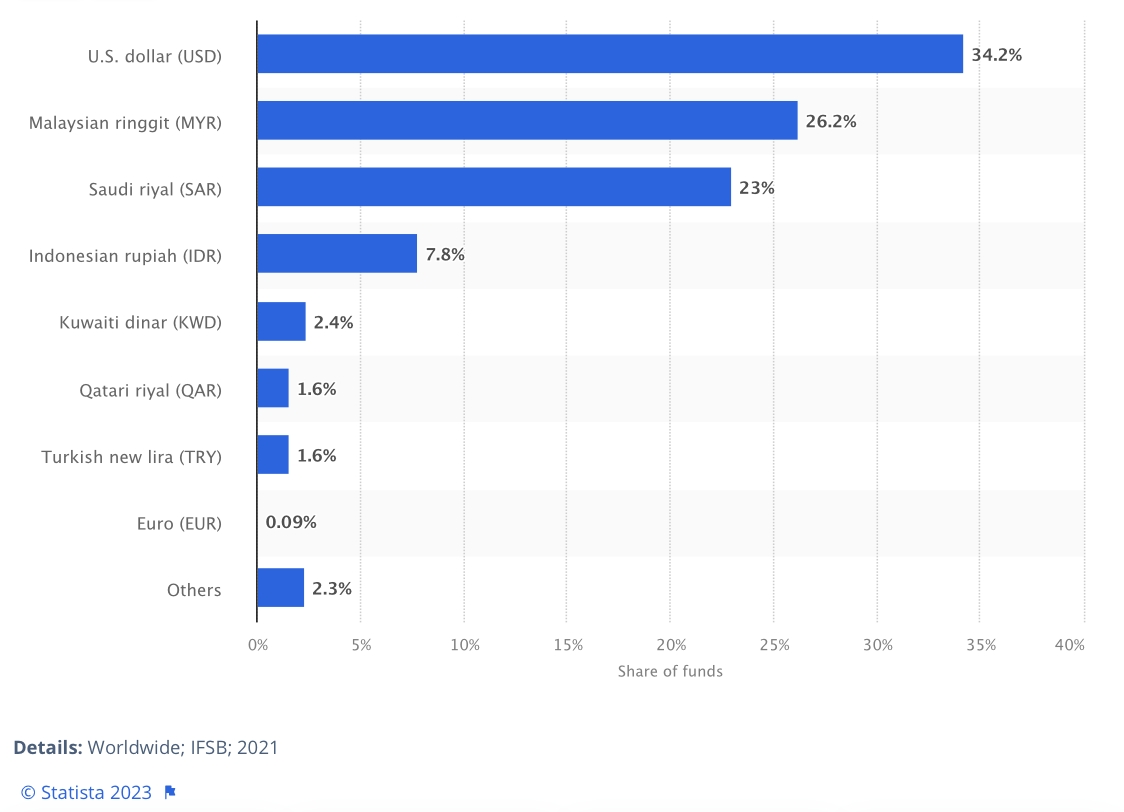

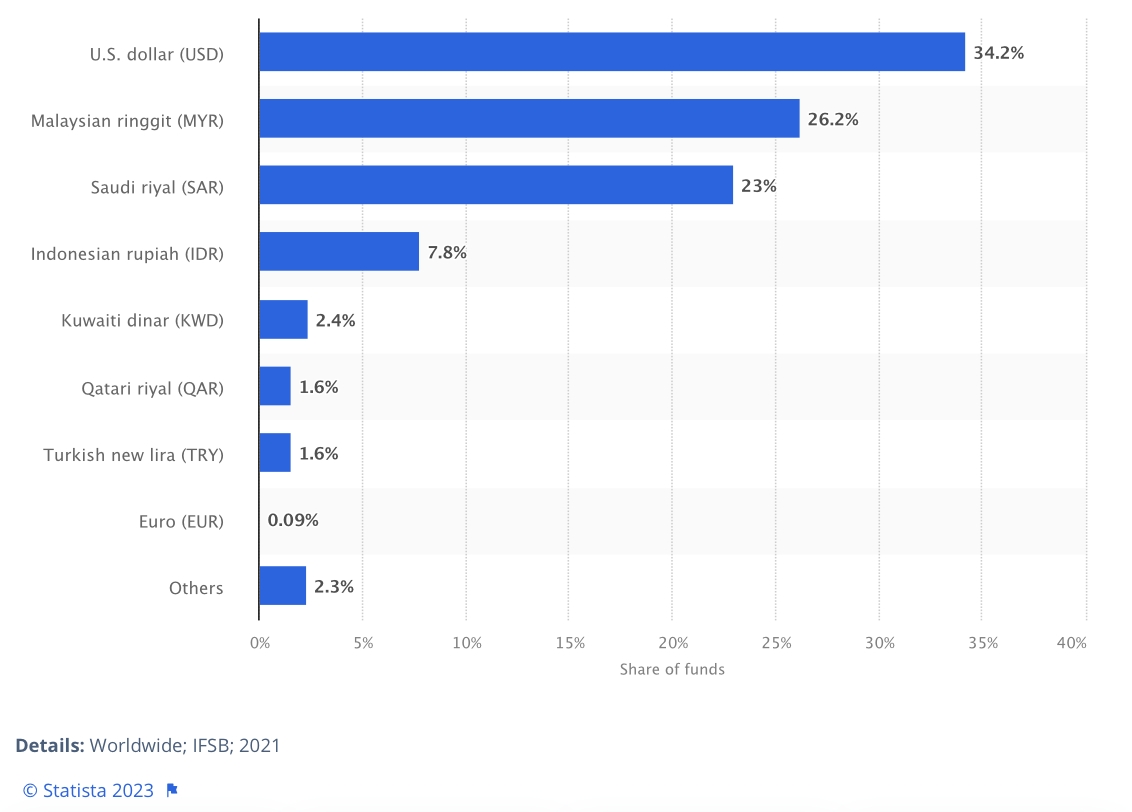

Interestingly, 34 per cent of Sukuk are issued in dollars. 26% in the currency of Malaysia and 23% in the currency of Saudi Arabia. Only 0.09% are issued in euro.

Takaful

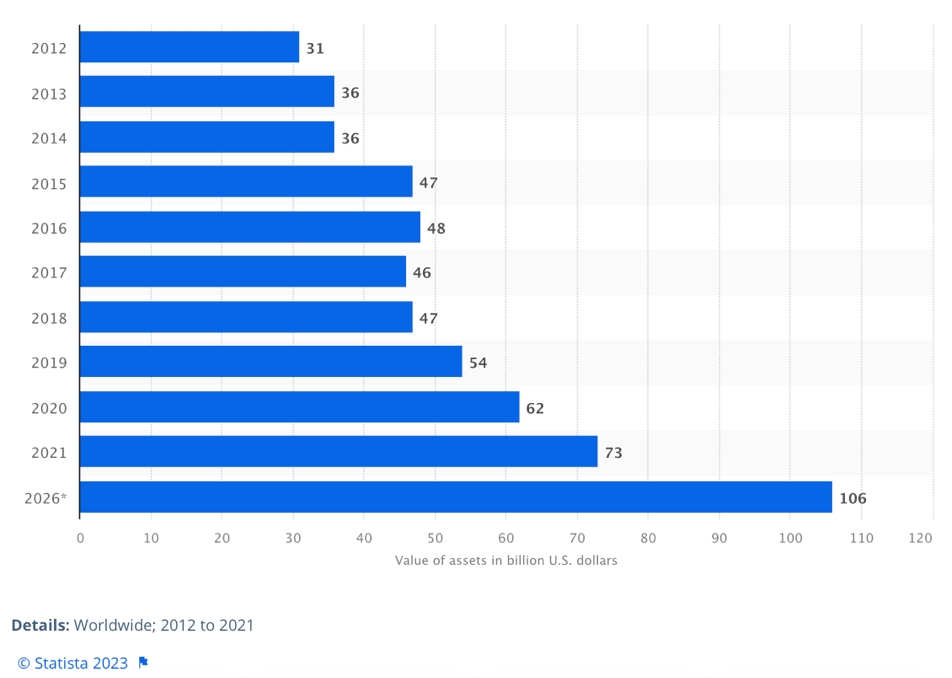

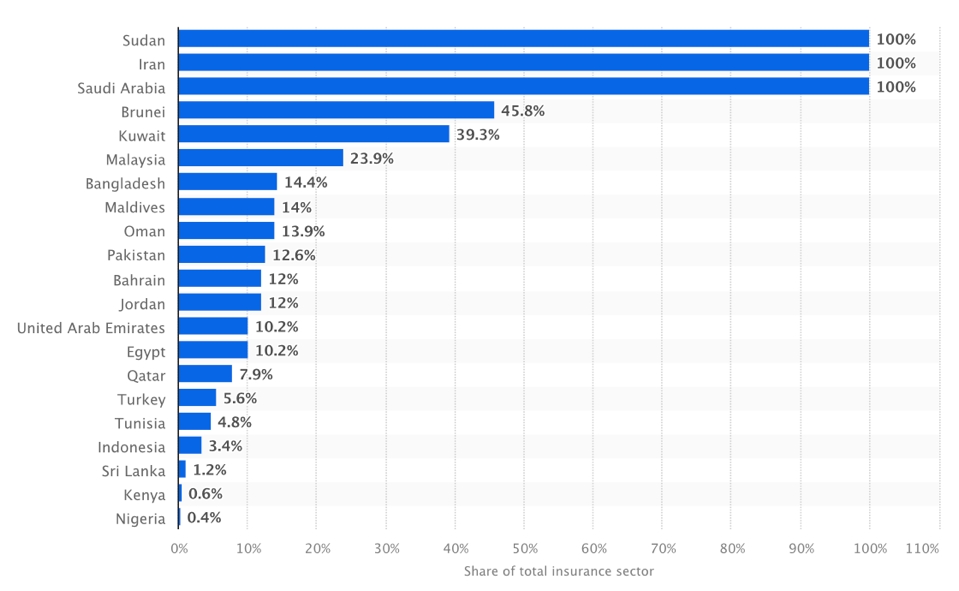

Takaful is a risk-sharing-based form of insurance similar to traditional insurance that allows for transparent risk-sharing, where participants contribute their resources to a common fund for the benefit of all. The Shariah-compliant insurance industry provides risk management support within the various markets that offer Islamic financial services. The following is some data from the ICD – Refinitiv Islamic finance development report (2022) on the value of Takaful and the contribution of different countries worldwide.